is oregon 529 college savings plan tax deductible

Oregon families can take tax credits worth up to 300 worth of contributions to the plan each year. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

Able Infographic By Oregon How To Plan Life Experiences Better Life

See Additions to tax in Publication OR-17 for more information.

. The annual gift tax exclusion in 2021 is 15k per individual. Currently the deduction is based strictly on contributions. If you invest 1000 and earn 5 during a year youre not taxed on the 50 you earned.

You can deduct up to a maximum of 4865 per year if you are Married Filing Jointly 2435 all others for contributions to a Oregon 529 College Savings Plan andor ABLE accounts made before the end of the current tax year. How 529 plan tax breaks work. Out-of-state participants still get the federal tax benefits.

This article will explain the tax deduction rules for 529 plans for current and future investors. You get a tax deduction for every dollar you contribute up to the maximum deductible amount. Federal tax liability subtraction.

You also get federal income tax benefits as you do not pay income tax on your earnings. And unlike other investment options when you withdraw those savings to use for educational expenses you can spend it tax-free too. For a short window of time Oregon taxpayers can qualify for both a deduction and a.

I have not seen a location to enter my 2020 contributions to the 529 plan. Families who invest in 529 plans may be eligible for tax deductions. Same subtraction codes 324 for 529 plans 360 for ABLE.

Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for education. Here are the special tax benefits and. On a federal-level there is no tax savings for contributions but qualified distributions are tax-free.

Oregon gives a tax credit for 529 contributions. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents. A 529 plan can be a great alternative to a private student loan.

The growth of your account isnt taxed either. The credit is up to 300 for joint filers and up to 150 for individuals. Oregon 529 College Savings and ABLE account plans 7 Subtraction carryforward Excess contributions made on or before December 31 2019.

The credit replaces the current tax deduction on January 1 2020. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300 MFJ in 2020. You do not need to be the owner of the account to contribute and claim the tax credit.

Consider a couple that contributes 25000 to their new babys Oregon 529 Plan account in 2019. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Whats more the investment earnings in your account are not reportable until the year they are withdrawn.

Subject to annual limits. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account and later made a nonqualified withdrawal of those contributions your credit s may have to be recaptured. For example in 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865.

Oregon wont allow 529 tax breaks for K-12 private school Published. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit.

The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual and up to 4865 by a married couple filing jointly in computing Oregon taxable income with a four-year carry forward of excess contributions. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from contributions in the 2020 year and is not a carryforward from 2019 as it specifies.

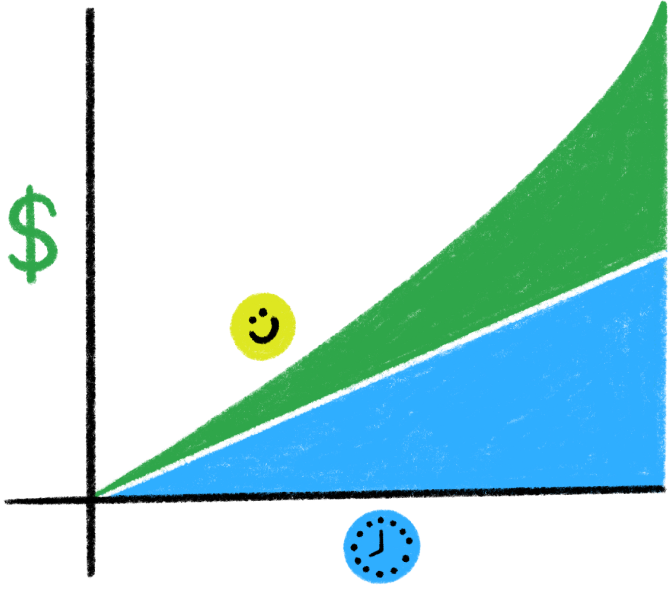

So what starts small grows over time. Plus you can get up to a 300 state income tax credit in oregon. Tax savings is one of the big benefits of using a 529 plan to save for college.

Short line railroad rehabilitation credit. That means they dont qualify for a tax deduction on your federal income taxes. Oregon 529 Plan Tax Information.

They would receive a tax deduction of 4865 on their 2019 taxes and could carry forward a deduction of 4865 every year for the next four years as long as their childs 529 Plan balance exceeds the deduction amount at the end of each tax year. Tax Benefits of the Oregon 529 Plan. 4960 for MFJ 2480 all others.

Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings plans. What Are The Federal And State Tax Advantages Of Opening An Oregon College Savings Plan Account. Can claim subtraction and credit on same return.

Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. 529 plan contributions are made with after-tax dollars. Single filers can take up to 150 in tax credits.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. 08 2018 1106 am. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct up to 20000.

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. 529 plans save taxpayers billions of dollars on their income taxes. Unlike an IRA contributions to a 529 plan are not deductible and therefore do not have to be reported on federal income tax returns.

The congressional tax breaks passed in December expanded 529s to apply to private K-12 schools. All oregon tax payers are eligible to contribute to an oregon college savings plan mfs 529 savings plan or oregon able savings plan and claim the state tax credit.

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

Our Thoughts On Oregon S 529 Plan Northwest Investment Counselors

Oregon 529 Plan And College Savings Options Or College Savings Plan

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Tax Benefits Oregon College Savings Plan

Oregon 20college 20savings 20plan Oregonlive Com

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

Pin By Koncept Design On Abstract Logo Logo Design Abstract Logo

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings